This tutorial gives hands-on experience on descriptive analysis (visualization, implied volatility) for option pricing, and model calibration on virtual option data (finding optimal initial start point for optimization routine, calibrating stochastic models on a dataset). The term “virtual option” means the option that do not exist in real market, but instead simulated from stochastic models.

C’est un support des travaux dirigés pour le cours de M2 “Financial Engineering and Risk Management” que j’ai enseigné aux étudiants de l’Université Paris-Sud en 2017 et 2018 (devenue désormais Paris-Saclay).

Calculating the implied volatility

Given Apple’s call option bid and ask data, calculate the implied volatility for the following call option and put option. Note: The implied volatility is the volatility that makes the option price from BS model equal to its actual market price.

\(K = 190\)

\(T-t = 151/365\)

\(q = 0.005\)

\(r = 0.0245\)

\(S_0 = 190.3\)

\(C = 10.875\)

\(P = 9.625\)

We import necessary modules:

import warnings

warnings.filterwarnings("ignore")

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from matplotlib import cm

%matplotlib inline

# for interactive figures

#%matplotlib notebook

from mpl_toolkits.mplot3d import Axes3D

from scipy import interpolate

from scipy.stats import norm

from scipy import optimize

import cmath

import math

Let’s load data from Excel:

# file name

excel_file = 'data_apple.xlsx'

# read data into a data frame

df = pd.read_excel(excel_file)

# create the 'Mid' variable

df['Mid'] = df[['Bid','Ask']].mean(axis=1)

# see some of the data

df.head()

| Option_type | Maturity_days | Strike | Ticker | Bid | Ask | Last | IVM | Volm | Mid | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | Call | 25 | 170.0 | AAPL 8/17/18 C170 | 21.150000 | 21.400000 | 20.65 | 30.762677 | 7 | 21.275000 |

| 1 | Call | 25 | 172.5 | AAPL 8/17/18 C172.5 | 18.649994 | 19.049988 | 0.00 | 29.173643 | 0 | 18.849991 |

| 2 | Call | 25 | 175.0 | AAPL 8/17/18 C175 | 16.449997 | 16.649994 | 16.50 | 28.306871 | 19 | 16.549995 |

| 3 | Call | 25 | 177.5 | AAPL 8/17/18 C177.5 | 14.100000 | 14.400000 | 0.00 | 26.967507 | 0 | 14.250000 |

| 4 | Call | 25 | 180.0 | AAPL 8/17/18 C180 | 12.050000 | 12.150000 | 12.10 | 26.321682 | 1129 | 12.100000 |

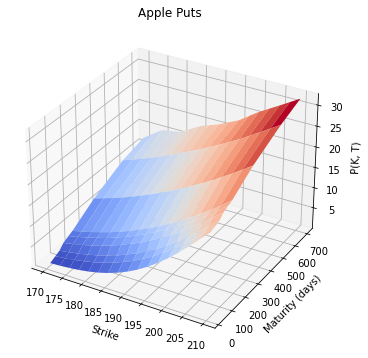

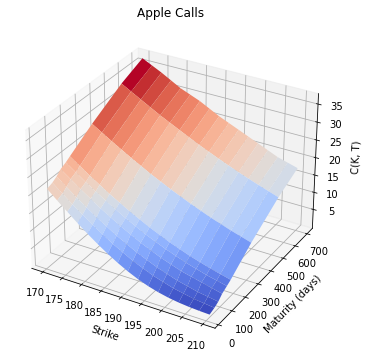

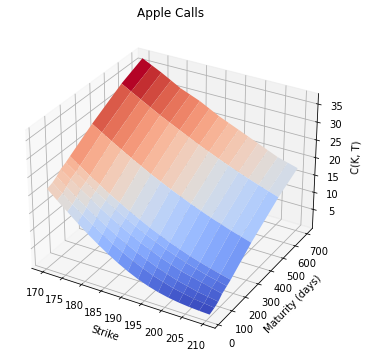

Plotting put options surface

Let’s plot put options surface for the given AAPL data. We use linear interpolation for missing strikes.

# define strikes and maturities

#all_strikes = np.sort(df_calls.Strike.unique())

all_strikes = np.arange(170., 210. + 2.5, 2.5)

all_maturities = np.sort(df.Maturity_days.unique())

print(all_strikes)

print(all_maturities)

[170. 172.5 175. 177.5 180. 182.5 185. 187.5 190. 192.5 195. 197.5

200. 202.5 205. 207.5 210. ]

[ 25 60 88 116 151 179 333 543 697]

df_puts = df[df['Option_type'] == 'Put'][['Maturity_days', 'Strike', 'Mid']]

df_puts.head()

| Maturity_days | Strike | Mid | |

|---|---|---|---|

| 17 | 25 | 170.0 | 0.435 |

| 18 | 25 | 172.5 | 0.570 |

| 19 | 25 | 175.0 | 0.765 |

| 20 | 25 | 177.5 | 1.035 |

| 21 | 25 | 180.0 | 1.415 |

# define a grid for the surface

X, Y = np.meshgrid(all_strikes, all_maturities)

Z_p = np.empty([len(all_maturities), len(all_strikes)])

# Use linear interpolation to fill missing strikes

for i in range(len(all_maturities)):

maturity_data = df_puts[df_puts['Maturity_days'] == all_maturities[i]]

# Interpolate for the mid prices

interp_func = interpolate.interp1d(maturity_data['Strike'], maturity_data['Mid'], kind='linear', fill_value="extrapolate")

# Fill the grid with interpolated values

Z_p[i, :] = interp_func(all_strikes)

# plot the surface

fig = plt.figure(figsize=(8,6))

ax = fig.add_subplot(111, projection='3d')

ax.plot_surface(X, Y, Z_p, cmap=cm.coolwarm)

ax.set_ylabel('Maturity (days)')

ax.set_xlabel('Strike')

ax.set_zlabel('P(K, T)')

ax.set_title('Apple Puts')

plt.savefig('fig3.png')

plt.show()

Calculate implied volatility

Calculate the implied volatility of the following call option and put option. The implied volatility is the volatility that makes the option price from BS model equal to its actual market price.

\(K\) = 190

\(T-t\) = 151/365

\(q\) = 0.005

\(r\) = 0.0245

\(S_0\) = 190.3

\(C\) = 10.875

\(P\) = 9.625

# select strike and maturity

K = 190.

T_days = 151

T_years = 1.* T_days / 365

# dividend rate

q = 0.005

# risk free rate

r = 0.0245

# spot price

S_0 = 190.3

# price

P_call = 10.875

P_put = 9.625

# utilize the following black scholes calculator to get the price from BS model

def BS_d1(S, K, r, q, sigma, tau):

''' Computes d1 for the Black Scholes formula '''

d1 = 1.0*(np.log(1.0 * S/K) + (r - q + sigma**2/2) * tau) / (sigma * np.sqrt(tau))

return d1

def BS_d2(S, K, r, q, sigma, tau):

''' Computes d2 for the Black Scholes formula '''

d2 = 1.0*(np.log(1.0 * S/K) + (r - q - sigma**2/2) * tau) / (sigma * np.sqrt(tau))

return d2

def BS_price(type_option, S, K, r, q, sigma, T, t=0):

''' Computes the Black Scholes price for a 'call' or 'put' option '''

tau = T - t

d1 = BS_d1(S, K, r, q, sigma, tau)

d2 = BS_d2(S, K, r, q, sigma, tau)

if type_option == 'call':

price = S * np.exp(-q * tau) * norm.cdf(d1) - K * np.exp(-r * tau) * norm.cdf(d2)

elif type_option == 'put':

price = K * np.exp(-r * tau) * norm.cdf(-d2) - S * np.exp(-q * tau) * norm.cdf(-d1)

return price

### part need to be finished ###

# auxiliary function for computing implied vol

def aux_imp_vol(sigma, P, type_option, S, K, r, q, T, t=0):

# Calculate the Black-Scholes price

bs_price = BS_price(type_option, S, K, r, q, sigma, T, t)

# Return the difference between the market price and the BS price

return bs_price - P

# compute implied vol

imp_vol_call = optimize.brentq(aux_imp_vol, 0.01, 0.4, args=(P_call, 'call', S_0, K, r, q, T_years))

imp_vol_put = optimize.brentq(aux_imp_vol, 0.01, 0.4, args=(P_put, 'put', S_0, K, r, q, T_years))

imp_vol_call, imp_vol_put

(0.20505479848219343, 0.2169237544182971)

Answer: the implied volatilities of the options are:

call: 0.2051

put: 0.2169

Heston model: searching optimal initial point

Given two sets of initial parameters of Heston model, \(P_1 = (1.0, 0.02, 0.05, -0.4, 0.08), P_2 = (3.0, 0.06, 0.10, -0.6, 0.04)\), find the optimal initial parameters set lying on the hyperparameter line between the given two parameters sets.

# import module needed for option pricing

import readPlotOptionSurface

import modulesForCalibration as mfc

# Parameters

alpha = 1.5

eta = 0.2

n = 12

# Model

model = 'Heston'

# risk free rate

r = 0.0245

# dividend rate

q = 0.005

# spot price

S0 = 190.3

params1 = (1.0, 0.02, 0.05, -0.4, 0.08)

params2 = (3.0, 0.06, 0.10, -0.6, 0.04)

iArray = []

rmseArray = []

rmseMin = 1e10

maturities, strikes, callPrices = readPlotOptionSurface.readNPlot()

marketPrices = callPrices

maturities_years = maturities/365.0

from scipy.optimize import minimize_scalar

# Note: You could use the eValue function in modulesForCalibration (mfc) to calculate the mean square error.

# For more detail about this function, please refer to modulesForCalibration.py

# Initialize optimal parameters and minimum RMSE

optimParams = params1

rmseMin = 10**6

# Initialize the search for optimal parameters between params1 and params2

kappa_range = np.linspace(params1[0], params2[0], num= int((params2[0]-params1[0])/0.01) + 1)

# Iterate through the parameter grid

def f(kappa):

theta = params1[1] + (kappa - params1[0])/(params2[0] - params1[0])*(params2[1] - params1[1])

sigma = params1[2] + (kappa - params1[0])/(params2[0] - params1[0])*(params2[2] - params1[2])

rho = params1[3] + (kappa - params1[0])/(params2[0] - params1[0])*(params2[3] - params1[3])

v0 = params1[4] + (kappa - params1[0])/(params2[0] - params1[0])*(params2[4] - params1[4])

print("kappa", kappa)

params = (kappa, theta, sigma, rho, v0)

return mfc.eValue(params, marketPrices, maturities_years, strikes, r, q, S0, alpha, eta, n, model)

result = minimize_scalar(f, bounds =(params1[0], params2[0]), method="bounded")

kappa 1.7639320225002102

kappa 2.23606797749979

kappa 2.5278640450004204

kappa 2.2914719396292194

kappa 2.306021558871544

kappa 2.306683816848725

kappa 2.3065629682560886

kappa 2.3065596007108975

kappa 2.30656633580128

result

fun: 0.8658456401462155

message: 'Solution found.'

nfev: 9

status: 0

success: True

x: 2.3065629682560886

The min-search algorithm converged after 9 iterations at \(K=2.30\). We can now calculate the other parameters.

kappa = result["x"]

theta = params1[1] + (kappa - params1[0])/(params2[0] - params1[0])*(params2[1] - params1[1])

sigma = params1[2] + (kappa - params1[0])/(params2[0] - params1[0])*(params2[2] - params1[2])

rho = params1[3] + (kappa - params1[0])/(params2[0] - params1[0])*(params2[3] - params1[3])

v0 = params1[4] + (kappa - params1[0])/(params2[0] - params1[0])*(params2[4] - params1[4])

theta, sigma, rho, v0

(0.046131259365121774,

0.08266407420640222,

-0.5306562968256089,

0.05386874063487823)

Answer: the optimal initial parameters are:

\(K = 2.31\)

\(\theta = 0.046\)

\(\sigma = 0.083\)

\(\rho = -0.53\)

Heston Model Calibration

Calibrate the Heston model for the given dataset ‘Virtual Option Data.csv’ by brute force. The searching range of parameters should be the followings:

\(2.5 \leq \kappa \leq 3.0\) with step 2.5

\(0.06 \leq \theta \leq 0.065\) with step 0.0025

\(0.1 \leq \sigma \leq 0.3\) with step 0.05

\(-0.675 \leq \rho \leq -0.625\) with step 0.025

\(0.04 \leq v_0 \leq 0.06\) with step 0.01

What is the calibrated value of \(κ\)?

What is the calibrated value of \(θ\)?

What is the calibrated value of \(σ\)?

What is the calibrated value of \(ρ\)?

# use the following fixed Parameters to calibrate the model

S0 = 100

K = 80

k = np.log(K)

r = 0.05

q = 0.015

# Parameters setting in fourier transform

alpha = 1.5

eta = 0.2

n = 12

N = 2**n

# step-size in log strike space

lda = (2*np.pi/N)/eta

#Choice of beta

beta = np.log(S0)-N*lda/2

# Model

model = 'Heston'

# calculate characteristic function of different models

def generic_CF(u, params, T, model):

if (model == 'GBM'):

sig = params[0];

mu = np.log(S0) + (r-q-sig**2/2)*T;

a = sig*np.sqrt(T);

phi = np.exp(1j*mu*u-(a*u)**2/2);

elif(model == 'Heston'):

kappa = params[0];

theta = params[1];

sigma = params[2];

rho = params[3];

v0 = params[4];

tmp = (kappa-1j*rho*sigma*u);

g = np.sqrt((sigma**2)*(u**2+1j*u)+tmp**2);

pow1 = 2*kappa*theta/(sigma**2);

numer1 = (kappa*theta*T*tmp)/(sigma**2) + 1j*u*T*r + 1j*u*math.log(S0);

log_denum1 = pow1 * np.log(np.cosh(g*T/2)+(tmp/g)*np.sinh(g*T/2));

tmp2 = ((u*u+1j*u)*v0)/(g/np.tanh(g*T/2)+tmp);

log_phi = numer1 - log_denum1 - tmp2;

phi = np.exp(log_phi);

elif (model == 'VG'):

sigma = params[0];

nu = params[1];

theta = params[2];

if (nu == 0):

mu = math.log(S0) + (r-q - theta -0.5*sigma**2)*T;

phi = math.exp(1j*u*mu) * math.exp((1j*theta*u-0.5*sigma**2*u**2)*T);

else:

mu = math.log(S0) + (r-q + math.log(1-theta*nu-0.5*sigma**2*nu)/nu)*T;

phi = cmath.exp(1j*u*mu)*((1-1j*nu*theta*u+0.5*nu*sigma**2*u**2)**(-T/nu));

return phi

# calculate option price by inverse fourier transform

def genericFFT(params, T):

# forming vector x and strikes km for m=1,...,N

km = []

xX = []

# discount factor

df = math.exp(-r*T)

for j in range(N):

nuJ=j*eta

km.append(beta+j*lda)

psi_nuJ = df*generic_CF(nuJ-(alpha+1)*1j, params, T, model)/((alpha + 1j*nuJ)*(alpha+1+1j*nuJ))

if j == 0:

wJ = (eta/2)

else:

wJ = eta

xX.append(cmath.exp(-1j*beta*nuJ)*psi_nuJ*wJ)

yY = np.fft.fft(xX)

cT_km = []

for i in range(N):

multiplier = math.exp(-alpha*km[i])/math.pi

cT_km.append(multiplier*np.real(yY[i]))

return km, cT_km

# myRange(a, b) return a generator [a, a+1, ..., b], which is different from built-in generator Range that returns [a, a+1,..., b-1].

# You may use it to perform brute force

def myRange(start, finish, increment):

while (start <= finish):

yield start

start += increment

# load virtual option data

data = pd.read_csv("Virtual Option Data.csv", index_col=0)

# generate strike and maturity array

strikes = np.array(data.index, dtype=float)

maturities = np.array(data.columns, dtype=float)

marketPrices = data.values

modelPrices = np.zeros_like(marketPrices)

maeMin = 1.0e6

### part need to be finished ###

kappa_range = list(myRange(2.5, 3.0, 0.25))

theta_range = list(myRange(0.06, 0.065, 0.0025))

sigma_range = list(myRange(0.1, 0.3, 0.05))

rho_range = list(myRange(-0.675, -0.625, 0.025))

v0_range = list(myRange(0.04, 0.06, 0.01))

for kappa in kappa_range:

print("kappa", kappa)

for theta in theta_range:

print("theta", theta)

for sigma in sigma_range:

print("sigma", sigma)

for rho in rho_range:

print("rho", rho)

for v0 in v0_range:

print("v0", v0)

params = (kappa, theta, sigma, rho, v0)

rmse = mfc.eValue(params, marketPrices, maturities_years, strikes, r, q, S0, alpha, eta, n, model)

iArray.append(params)

rmseArray.append(rmse)

print(rmse)

if rmse < rmseMin:

rmseMin = rmse

optimParams = params

print(rmseMin)

print(optimParams)

Answer: the calibrated values are:

\(κ = 2.75\)

\(θ = 0.06\)

\(σ = 0.25\)

\(ρ = -0.65\)